Basis Rente (Rürup Rente)

In Germany, Basis Rente, also known as Rürup Rente, is a tax-advantaged retirement savings option designed to provide long-term financial security. Tailored for self-employed individuals and high earners, Basis Rente offers tax benefits and flexible contribution options to help individuals build a reliable pension fund for retirement.

What Is the Basis Rente?

The Basisrente was introduced in 2005. It is also known as Rürup Rente after the person who introduced the plan.

In the 1st layer, provident expenses can be offset against tax. Contributions made to the state pension scheme and Basisrente can be offset up to a maximum of €29,344.00 for singles and €58,688.00 for couples (married or registered partnerships). A single person earning €85,000 per year and contributing (including employer contributions) the maximum amount of €15,735.60 to the German state pension system can still offset €11,376.40 per year (or €948 per month) against tax with their Basisrente.

What Changes in 2024 Regarding Tax Offsetting?

How is the Pension from Basis Rente Taxed?

The monthly pension received is taxable at the personal tax rate for the pensioner. Tax regulations for pensioners differ from those for individuals who are still working. It is possible to pay in and over the €29,344.00/€58,688.00 limits, but it will not provide any additional tax benefit.

What Kind of Investment Options Does Basis Rente Offer?

Most Basisrente products are fund-based and offer a variety of funds to choose from, including managed portfolios. Insurance-based products allow you to switch funds up to 12 times a year, free of charge. Capital within a Basisrente cannot be borrowed against or seized, and it is protected from unemployment and insolvency.

How Long Does the Contract Last and When Can You Start Drawing the Pension?

The minimum contract duration is 5 years, and the pension is guaranteed for the rest of the policyholder’s life. The pension can be drawn starting at age 63 through a bank account in Germany, with no option for a lump-sum withdrawal.

What Happens to the Basis Rente in Case of Death?

If the policyholder dies during the paying-in phase, the accumulated amount will be converted and paid to the legal beneficiary. If death occurs while drawing the pension, payments will continue to the beneficiary for the arranged period (Garantiezeit), which can range from 5 to 18 years. The only qualified beneficiaries in case of death are the spouse (or registered partner) and children until they complete their first education, up to the age of 25.

What Happens to the Basis Rente if You Leave Germany?

If the policyholder leaves Germany, the Basisrente policy becomes non-contributory. However, the investment continues to work through fund contributions, and it’s advisable to maintain a forwarding address in Germany.

For whom is the Rürup pension worthwhile?

The Rürup pension, also known as the basis pension, is particularly beneficial for self-employed individuals, freelancers, and high-income earners who are looking for tax-efficient retirement savings options. Due to its tax advantages and flexibility, the Rürup pension can also be suitable for individuals with fluctuating incomes or those who anticipate higher tax burdens in retirement.

How does the Rürup pension work?

The Rürup pension operates as a tax-advantaged retirement savings vehicle in Germany. Individuals contribute to their Rürup pension plans, and these contributions are tax-deductible, subject to certain limits. The accumulated funds are invested in fund-based products, offering a range of investment options. Upon retirement, the Rürup pension provides a lifelong pension income, which is taxable at the individual’s personal tax rate.

How long is the Rürup pension paid?

The Rürup pension provides pension payments for the rest of the policyholder’s life, ensuring financial security throughout retirement. The duration of Rürup pension payments is not limited by a specific term, unlike some other pension products. This lifetime income stream offers stability and peace of mind, making the Rürup pension a popular choice for long-term retirement planning.

What is the difference between Riester and Rürup?

The key difference between Riester and Rürup pensions lies in their eligibility criteria, tax treatment, and contribution limits. While both pensions offer tax advantages, Riester pensions are primarily designed for employees and certain eligible groups, such as civil servants and soldiers, who receive government subsidies. In contrast, Rürup pensions are geared towards self-employed individuals and high-income earners, offering tax deductions on contributions. Additionally, Rürup pensions have higher contribution limits compared to Riester pensions, making them suitable for individuals seeking tax-efficient retirement savings options tailored to their specific circumstances. Ready to explore the best pension plan for your needs? Contact MW Expat today for expert guidance tailored to your financial goals.

You can pay up to €29,344.00/year into the scheme if you are single or up to €58,688.00 if you are married

The premiums can be offset against tax. You have the option of paying low monthly premiums and then towards the end of the year, after seeing how much you will earn, paying a lump sum to save paying taxes. It pays out as a life long pension and the earliest that the pension can be drawn is age 63. The pension will be liable for tax at the rate you pay as a pensioner. There is no option of receiving a capital payment.

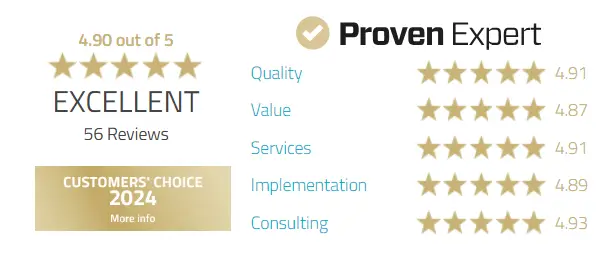

What our clients say about our services

Secure your future abroad with tailored insurance & pension plans

Get expert advice on the best solutions for expats – personalized to fit your unique needs. Start planning today!