German Pension Calculator

Tax-Efficient Retirement Made Simple

Our English speaking advisors will help you to find your best pension planning option for Germany. Start the pension calculator below to get an free consultation.

Use our pension calculator to secure your future

- Let Germany work for your pension

- Use available tax benefits

- Make the most of German state subsidies

- Solutions from reputable companies

- Financial security through German state regulations

To make sure we connect you with the right advisor, please go through our pension calculator and answer the following questions.

How the German pension system can work for you

The German state pension scheme (Gesetzliche Rentenversicherung) is the cornerstone of pension planning in Germany. The German government is actively encouraging its inhabitants towards private pension planning by a system of mostly tax subsidised, insurance-based solutions:

- Multiple pension product solutions

- Significant tax and subsidy benefits

- Guaranteed return on investments available

- Large and secure providers

- All products regulated by the German authorities.

- All advice covered by our Professional Indemnity Insurance

Unfortunately, very few expats realise that they can also take advantage of these benefits whilst living and working in Germany.

How we can help you to plan your retirement

Pension planning is a crucial part of your wealth management, and it’s never too early to start thinking about investing.

MW Expat Solution Services GmbH advisers provide sound advice taking into account all the different needs of our globally minded clients and have expertise in the German insurance market.

Our advisers will examine your long-term goals and guide you through all the options that could work for you, providing regular internal audits of all client portfolios, clarification on national and international decision implications concerning retirement planning and forewarning of eventual regulation changes.

Ready to plan your pension?

Our pension and savings specialists will be happy to help!

Adriana Gonzalez

Health Insurance & Pensions Specialist

Adriana is originally from Colombia. She moved to Germany in 2002 and has been in your shoes. She has been a valued member of the team since 2020.

Matthias Wolf

Managing Director, Pensions & Savings Specialist

Matthias is one of the most experienced pensions and savings specialists for expats in the DACH region. He’s been in the field for more than 20 years now.

Anja Lampert

Health Insurance & Pensions Specialist

Anja is our language talent: she advises fluently in German, English and Italian. She has been a valued member of the team since 2018.

How high is the pension in Germany?

The pension amount in Germany varies based on a multitude of factors, encompassing the individual’s earnings track record, contributions channeled into the state pension system, and other pertinent considerations. The German state pension system, known as Gesetzliche Rentenversicherung (GRV), calculates pensions based on various criteria, ensuring that each individual’s retirement income is reflective of their unique circumstances. For tailored insights into potential pension amounts, individuals can turn to pension calculators provided by reputable financial advisors such as MW Expat Solution Services GmbH.

What is the lowest pension in Germany?

The pension amount in Germany varies based on a multitude of factors, encompassing the individual’s earnings track record, contributions channeled into the state pension system, and other pertinent considerations. The German state pension system, known as Gesetzliche Rentenversicherung (GRV), calculates pensions based on various criteria, ensuring that each individual’s retirement income is reflective of their unique circumstances. For tailored insights into potential pension amounts, individuals can turn to pension calculators provided by reputable financial advisors such as MW Expat Solution Services GmbH.

What is the highest pension one can receive in Germany?

The highest pension amount attainable in Germany is subject to numerous factors, encompassing an individual’s earnings history, contributions made to the state pension system, and other relevant considerations. Although there’s no specific upper limit on pension amounts, pensions are typically calculated as a percentage of the contributor’s average earnings over their working life. By leveraging pension calculators offered by reputable financial advisors like MW Expat Solution Services GmbH, individuals can gain insights into potential pension amounts aligned with their unique circumstances and contributions.

How long does one have to work in Germany to receive a pension?

The duration of employment required to qualify for a pension in Germany is contingent upon various factors, including an individual’s work history, contributions to the state pension system, and specific eligibility criteria. While individuals typically need to contribute for a minimum period to qualify for a basic pension, longer contribution periods may be necessary to access higher pension amounts. Navigating the intricacies of pension eligibility criteria can be facilitated through expert guidance provided by financial advisors like MW Expat Solution Services GmbH, who offer personalized advice tailored to individual circumstances.

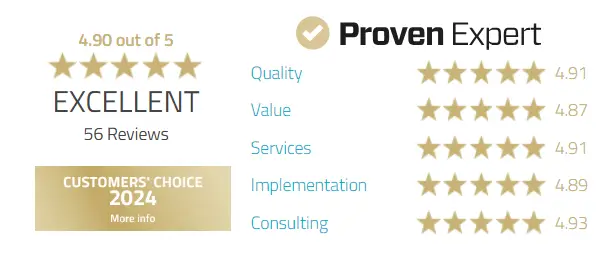

What our clients say about our services

Secure your future abroad with tailored insurance & pension plans

Get expert advice on the best solutions for expats – personalized to fit your unique needs. Start planning today!