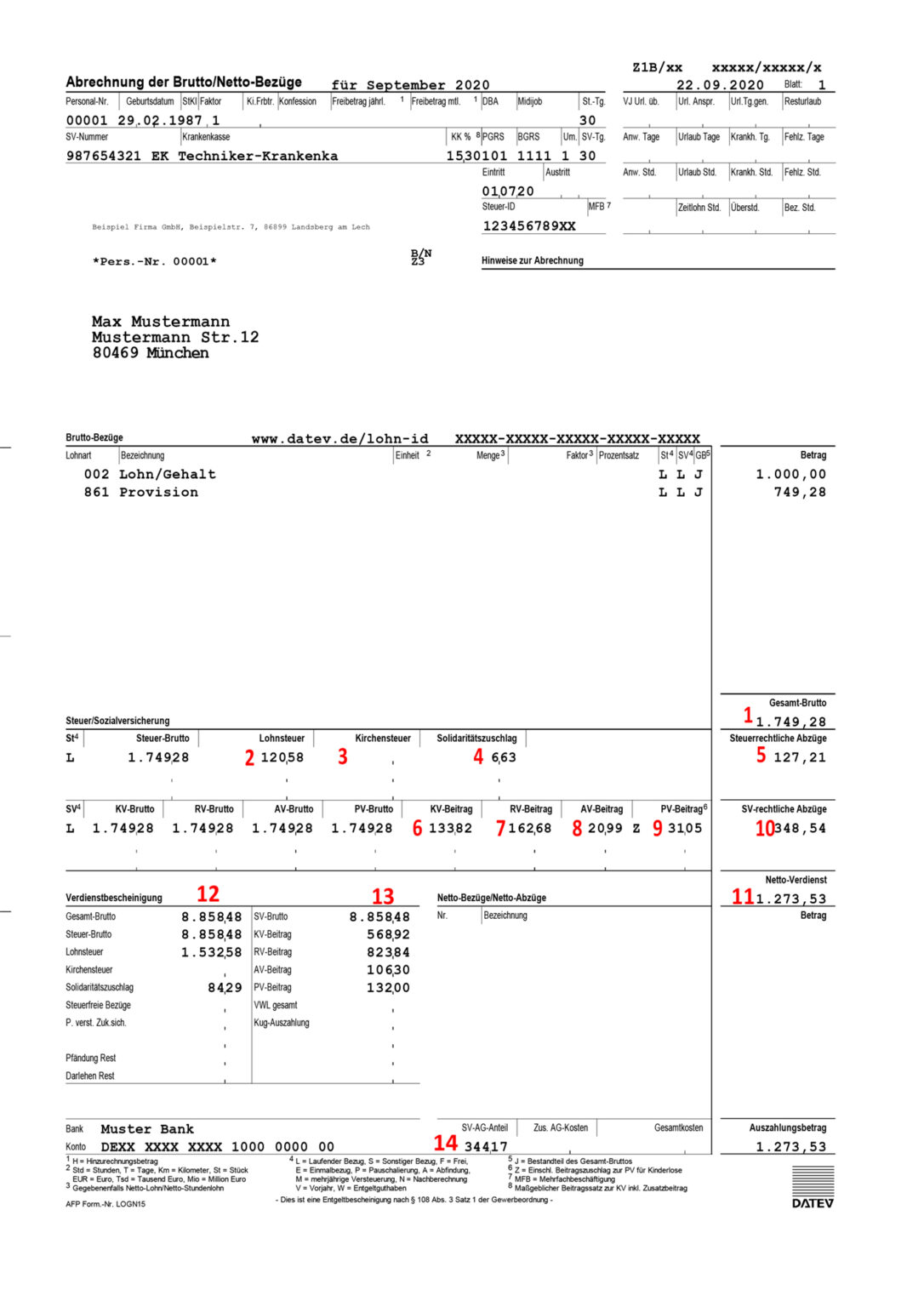

Total gross salary

The gross salary includes the income, the employee’s social security contributions and the tax to be paid to the tax office.

Tax

The tax deduction is transferred by the employer to the tax office. The amount is calculated progressively: The more the employee earns, the more tax is withheld. The normal tax bracket ranges from 14% to 42%, normally the truth lies somewhere in the middle.

Church tax

Church tax in Germany is 8% or 9% depending on the federal state. It is paid by the employer for Catholic or Protestant church members via the state to the churches. The charges are calculated on your income tax.

Solidarity surcharge

Since 2021, the solidarity surcharge has been waived up to an annual income of around 73000 euros. From this income upwards, the solidarity tax is charged at 5,5% and is calculated from your tax bill. The solidarity tax was introduced to pay for the reconstruction of East Germany after Germany became unified again.

Total tax to be paid

Income tax plus solidarity surcharge and church tax.

Employee contribution to statutory health insurance

The total cost of statutory health insurance is 14.6%, with the employer and the employee (7.3%) each paying half. The employee may have to pay an additional contribution of about 1.3%, as determined by the health insurance provider.

Employee contribution to statutory pension insurance

This is paid in equal parts by the employer and the employee. It amounts to a total of 18.6% of the gross wage.

Unemployment insurance

A total of 2.4% of the salary. Employer and employee each pay half.

Compulsory long-term care insurance

A total of 3.05% is paid for this. Half from the employer and half from the employee, childless employees have to pay a further supplement of 0.25% as of the age of 23

Total deductions for social insurance (employee’s share)

Net salary

This is the amount transferred to the employee’s account.

Total tax payments

Income tax, solidarity surcharge and church tax accrued in the year

Total social security payments

Health insurance, pension insurance, unemployment insurance and compulsory long-term care insurance accrued in the year

Social security contribution payable by the employer in the month

That is a lot of money taken off your gross salary every month and the strange thing is that we find with dealing with expats every day that most of them do not have a clue as to why they are losing so much of their gross income. To be fair that German state takes a lot, but they also give a lot back if you know your way around the system. In the following two articles, we will show you ways of saving taxes and social security costs whilst having better health care cover and building for your future.

*The above illustration and text are all based on the average employee here in Germany. There are many exceptions to these rules and if you would like to be 100% sure about your personal situation then it is best to seek professional advice from either a qualified accountant or a lawyer specializing in social law.

Secure your future abroad with tailored insurance & pension plans

Get expert advice on the best solutions for expats – personalized to fit your unique needs. Start planning today!