term Life Insurance

A term life insurance (Risikolebensversicherung) provides essential financial protection for your loved ones in the unfortunate event of your passing. With flexible coverage options and affordable premiums, term life insurance ensures peace of mind for you and your family. Explore our range of term life insurance policies tailored to your needs today.

Term Life Insurance in Germany – 5 Facts

Do You Need Term Life Insurance in Germany?

If you’re single or don’t have dependents, you may not prioritize getting term life insurance in Germany. However, if you have a family or people who depend on you financially, opting for term life insurance can be one of the smartest decisions you make.

What Factors Affect the Cost of Term Life Insurance?

The cost of term life insurance in Germany depends on several factors, including the sum assured, the length of the insurance term, your age, and your medical status and history. The younger and healthier you are, the more affordable your premium is likely to be.

How Do You Choose the Right Insurance Duration?

The duration of your insurance can be tailored to your specific situation. For instance, if you have a mortgage that you’ll finish paying by age 57, you can set your insurance term to end when you reach 57. However, the longer your insurance runs, the more expensive your premium becomes, as the likelihood of death increases with age.

One key benefit of having this form of insurance is the cause of death (unless self-inflicted) is not given importance by the providers of term life insurance in Germany. However, that is also the main reason the insurance providers remain very careful about your health conditions when you approach them for taking out such insurance.

What Happens During the Application Process?

When applying for term life insurance, you’ll be asked to fill out detailed and specific questions about your health. If you’re opting for a larger sum assured, you may also need to visit a doctor for a thorough health check. Insurers want to assess your health to determine the risk —good health may mean a lower premium, while pre-existing conditions or higher risks could increase your premium or even result in a rejection.

Can You Get Term Life Insurance Without a Medical Check?

Yes, but term life insurance plans that don’t require a medical check-up typically offer lower coverage. This is because insurers have to account for the unknown risks that come with your undisclosed health conditions, which makes the policy riskier for them.

Complete the form to connect with our pension expert and receive complimentary advice

Safeguard The Financial Aspect Of Your Dependents After Your Death By Taking Out Term Life Insurance.

If you have got dependents and you are the main earning member in your family you can always choose how much money you want to have insured through term insurance, you should do so wisely. Generally, this amount needs to be high enough so that your family can conveniently live on after your death and can pay off any outstanding mortgages and loans. Many financial institutions insist on the second aspect before they approve your mortgage application. While people usually choose their family as the beneficiary of their term life insurance, it is not mandatory. You are free to specify anybody as the beneficiary of the policy.

How does life insurance work in Germany?

Understanding how life insurance functions in Germany involves considering various factors, including the types of policies available, eligibility criteria, and the process of obtaining coverage. Life insurance in Germany typically provides financial protection for policyholders’ beneficiaries in the event of the policyholder’s death. Policies may vary in terms of coverage amounts, premium payments, and other features, depending on individual preferences and insurance providers. To gain insight into the intricacies of life insurance in Germany and explore suitable options, individuals can seek guidance from experienced insurance advisors like MW Expat Solution Services GmbH, who offer expertise in navigating the German insurance landscape. Explore our comprehensive pension planning services to ensure a secure retirement future.

What happens to my life insurance if I move abroad?

If you move abroad, the status of your life insurance policy may depend on various factors, including the policy terms and conditions, the insurance provider’s policies, and the destination country’s regulations. In some cases, life insurance policies may offer coverage worldwide, allowing policyholders to maintain their coverage even after relocating. However, other policies may have limitations or exclusions based on residency or travel destinations. It’s essential for individuals planning to move abroad to review their life insurance policies carefully and consider whether adjustments or additional coverage may be necessary to ensure continued protection. Seeking guidance from experienced insurance advisors like MW Expat Solution Services GmbH can help individuals navigate the implications of relocating abroad on their life insurance coverage and explore suitable options for maintaining or adjusting their policies accordingly.Is life insurance taxed in Germany?

Life insurance in Germany may be subject to taxation, depending on various factors such as policy type, premium payments, and policyholder status. While life insurance premiums are typically not tax-deductible for individuals, the taxation of life insurance benefits in Germany varies depending on whether the policy is classified as risk insurance or investment insurance. Risk insurance policies, such as term life insurance, generally offer tax-free benefits to beneficiaries. In contrast, investment insurance policies may be subject to taxation on investment gains and interest income. Understanding the tax implications of life insurance in Germany is essential for individuals seeking financial planning strategies. Consulting with tax and insurance experts like MW Expat Solution Services GmbH can provide clarity on tax considerations related to life insurance and help optimize financial planning strategies accordingly.

Get a personalized Term Life Insurance quote

Please answer the following questions to help us find the best Term Life Insurance insurance in Germany that best suits your needs and is available at the best price. Once we receive the questionnaire, we’ll contact you soon.

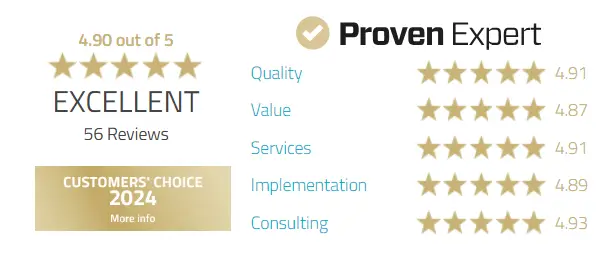

What our clients say about our services

Secure your future abroad with tailored insurance & pension plans

Get expert advice on the best solutions for expats – personalized to fit your unique needs. Start planning today!