Income

Income is one of the biggest determining factors when choosing between private and public health insurance in Germany. Your income level can determine which health insurance you choose and also how much your health insurance covers.

If your income is below €64350 per year, your only option is to go for public health insurance, and you are insured on a compulsory basis. This means you must have public health insurance while you are living in Germany, and additionally, public health insurers will also be forced to accept your case, even if you suffer from any severe underlying health conditions.

If your income is above €64350, you have the option to choose between public and private health insurance in Germany. Since you have this option, public health insurers are also not forced to accept you unless it is your first employment in Germany and you are coming from another state system.

If you are self-employed and come from another European public system then you can choose which system you would like to join regardless of your expected income. If you do not come from another Public insurance then private insurance is often your only choice.

Public health insurance is usually less expensive when you have a low income. Since you are not earning that much, you don’t have to pay that much for your health insurance. Even if you suddenly lose your job or retire, your health insurance will match your income and stay affordable.

The main difference between the two systems is that the public insurance is a family insurance, this means that you go to work and unless your family earns their own income they are automatically insured under your one premium. With the private insurance everybody has to insure themselves meaning that if you have a large family that is not working then private insurance will work out to be more expensive.

The other side of that is that if you are young, healthy and single then private insurance will not only be a lot cheaper for you but also offer you far better coverage.

Occupation

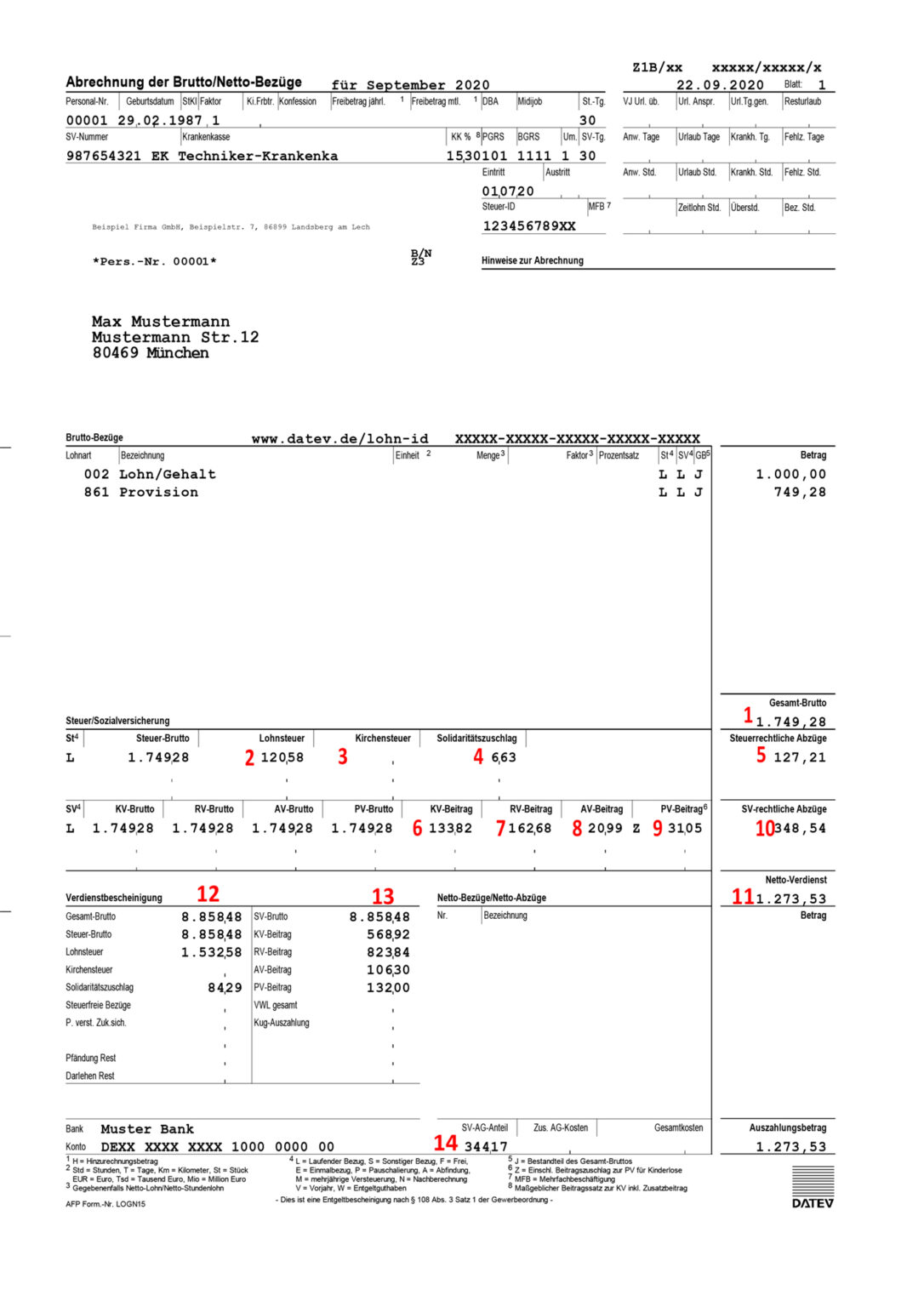

Your occupation is the second most crucial factor determining your health insurance. In most cases, if your income is above €64350, you can choose between private and public health insurance. However, your salary can determine your exact contribution to your health insurance every month.

For instance, if you are an employee and earn more than €58050 every year, your maximum monthly contribution comes to about €460, while your employer pays the other half. If you are working as an apprentice and earn less than €325 every month, your employer has to bear the total cost of your insurance.

Similarly, if you are a freelancer and earn more than €58050 annually, your maximum insurance payment can go up to €920 every month. On the other hand, if you make less than €12740 every year, your minimum payment is €180 per month.

If you are unemployed at the moment, in that case, you also have to pay a minimum of €180 per month. However, you also have the option of using your spouse’s insurance for free. Moreover, once you register your unemployment status with the government, they bear the full expense of your health insurance.

Treatments and Coverage

Another significant difference between the two is in the coverage and level of treatment. Public health insurance usually offers limited coverage and only covers the basic treatments. If you want more coverage for certain specific conditions, you will have to opt for private supplementary health insurance and pay more for that.

Moreover, you can also expect better treatment with private health insurance as the doctor can charge more money, this does not affect you because you will be reimbursed by the private insurance company and you only have to pay your fixed premium. One of the very important factors here is the speed at which you will get appointments to see a specialist, with public insurance it can often take weeks.

Paperwork

Public health insurance is usually much more convenient as you need to get through loads of paperwork. Most of the process is handled by the insurance company and doctors directly, and all you need to do is show up with your insurance card. The drawback with this system is that it is not transparent as you do not get to see the diagnosis that the doctor registers with the public health provider, this often leads to problems when applying for other kinds of insurances or jobs where your state of health is relevant.

All private providers have apps where you just have to take a photo of the invoice from the doctor and then you will be automatically reimbursed to your account. Once you have the reimbursement you then have to transfer the amount of the invoice to the doctor, this is slightly more work but you stay in control.

Pre-existing Health Conditions

If you have certain pre-existing health conditions, are an employee, and make less than €64350 per year, public health insurance can be a better choice. The insurers can’t refuse to offer you insurance, and you don’t have to pay extra for your pre-existing conditions either.

If you have certain pre-existing health conditions, are an employee, and make less than €64350 per year, public health insurance can be a better choice. The insurers can’t refuse to offer you insurance, and you don’t have to pay extra for your pre-existing conditions either.

Final Thoughts

Whether you decide to go for private or public health insurance, either way, you must sign up for some insurance policy. Accidents and medical surprises don’t come with a warning. Even if you’re feeling perfectly healthy today, there’s no guarantee for tomorrow. Under German social law Health care is mandatory and everybody moving to Germany has to sign up to a compliant plan within one month of arrival.

Therefore, a health insurance plan is your best bet for efficient medical treatments and peace of mind rather than worry about future medical costs. Get in touch with MW Expat Solution Services GmbH for more expert advice and guidance on how to get your health insurance in Germany.