Term Life Insurance

A term life insurance (Risikolebensversicherung) provides essential financial protection for your loved ones in the unfortunate event of your passing. With flexible coverage options and affordable premiums, term life insurance ensures peace of mind for you and your family. Explore our range of term life insurance policies tailored to your needs today.

A Term Life Insurance – Key Things To Know

- If you are on your own or do not have any dependents, you may not want to prioritize opting for term life insurance in Germany. But if you have got a family or dependents, it can prove to be one of your most sensible decisions.

- The cost of term life insurance depends on several factors. These mainly include the assured sum, the insurance term, the policyholder’s age, and the policyholder’s medical status and history

- You can choose the duration of your insurance depending on your individual situation. For example, if you have taken out a mortgage that you will be able to pay off by the time you become 57 years old, you can choose to have the term insurance continue till you become 57. Basically, the longer the length of time your insurance runs, the more expensive your premium will become. This is because as you get older, the chances of you passing away go up.

- One key benefit of having this form of insurance is the cause of death (unless self-inflicted) is not given importance by the providers of term life insurance in Germany. However, that is also the main reason the insurance providers remain very careful about your health conditions when you approach them for taking out such insurance.

- When filling out the application form, you will have to answer very specific and comprehensive questions. And if you want to opt for a larger assured sum, the insurance provider will likely ask you to see a doctor and have a thorough health check-up done. Here, the main objective of the insurer is to know your exact health conditions. If you have good physical health, your premium will likely be lower. But if you have got pre-existing medical conditions that indicate a higher risk factor, you will likely have to pay a higher premium. And if the risk factor is too high, the insurance company may reject your application.

- Another important thing is term plans that do not require any medical check-up, almost always provide lower coverage. This is because the insurance company needs to compensate for the risks associated with your unknown medical conditions that have not been revealed to them.

Complete the form to connect with our pension expert and receive complimentary advice

Safeguard The Financial Aspect Of Your Dependents After Your Death By Taking Out Term Life Insurance.

If you have got dependents and you are the main earning member in your family you can always choose how much money you want to have insured through term insurance, you should do so wisely. Generally, this amount needs to be high enough so that your family can conveniently live on after your death and can pay off any outstanding mortgages and loans. Many financial institutions insist on the second aspect before they approve your mortgage application. While people usually choose their family as the beneficiary of their term life insurance, it is not mandatory. You are free to specify anybody as the beneficiary of the policy.

How does life insurance work in Germany?

Understanding how life insurance functions in Germany involves considering various factors, including the types of policies available, eligibility criteria, and the process of obtaining coverage. Life insurance in Germany typically provides financial protection for policyholders’ beneficiaries in the event of the policyholder’s death. Policies may vary in terms of coverage amounts, premium payments, and other features, depending on individual preferences and insurance providers. To gain insight into the intricacies of life insurance in Germany and explore suitable options, individuals can seek guidance from experienced insurance advisors like MW Expat Solution Services GmbH, who offer expertise in navigating the German insurance landscape.

Explore our comprehensive pension planning services to ensure a secure retirement future.

What happens to my life insurance if I move abroad?

If you move abroad, the status of your life insurance policy may depend on various factors, including the policy terms and conditions, the insurance provider’s policies, and the destination country’s regulations. In some cases, life insurance policies may offer coverage worldwide, allowing policyholders to maintain their coverage even after relocating. However, other policies may have limitations or exclusions based on residency or travel destinations. It’s essential for individuals planning to move abroad to review their life insurance policies carefully and consider whether adjustments or additional coverage may be necessary to ensure continued protection. Seeking guidance from experienced insurance advisors like MW Expat Solution Services GmbH can help individuals navigate the implications of relocating abroad on their life insurance coverage and explore suitable options for maintaining or adjusting their policies accordingly.

Is life insurance taxed in Germany?

Life insurance in Germany may be subject to taxation, depending on various factors such as policy type, premium payments, and policyholder status. While life insurance premiums are typically not tax-deductible for individuals, the taxation of life insurance benefits in Germany varies depending on whether the policy is classified as risk insurance or investment insurance. Risk insurance policies, such as term life insurance, generally offer tax-free benefits to beneficiaries. In contrast, investment insurance policies may be subject to taxation on investment gains and interest income. Understanding the tax implications of life insurance in Germany is essential for individuals seeking financial planning strategies. Consulting with tax and insurance experts like MW Expat Solution Services GmbH can provide clarity on tax considerations related to life insurance and help optimize financial planning strategies accordingly.

Get a personalized Term Life Insurance quote

Please answer the following questions to help us find the best Term Life Insurance insurance in Germany that best suits your needs and is available at the best price. Once we receive the questionnaire, we’ll contact you soon.

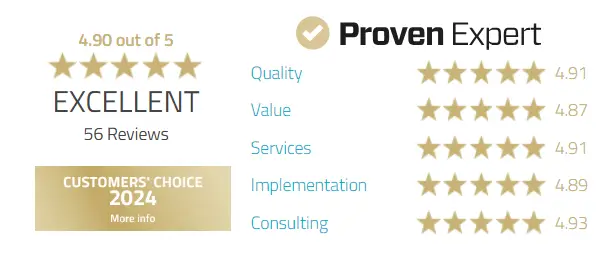

What our clients say about our services